This was a draft. The final version is now available as a pay-what-you-want self-published book called Tom’s Finance Guide: Retire Rich!

There are smart and dumb ways to get out of debt. First I’ll tell you about the dumb way because that’s what I did and I want to save you from the pain that I went through. However, instead of being all judgemental and calling it “dumb” I’ll just call it “the wrong way”.

The wrong way

In my mid-20s I was crushed by credit card debt. I had $20k in credit card debt and other 20k in student loans. I knew I wanted to get out of debt, but I didn’t know how.

I had about 5 credit cards plus 2 student loans: Twelve individual payments each month!

(Sidenote: this was pre-internet which meant I was writing 7 checks a month, buying stamps and envelopes, going to the post-office box to drop them off, etc. It took an hour each week to stay on top of all that. You don’t know how lucky you have it today with electronic payments!)

Anyway…

Here’s the failed strategy that was my first attempt: I figured that if I wanted to get rid of all this debt quickly, paying the minimum on each of these 7 accounts would take forever. So I decided to pay twice the minimum on each debt each month. Simple!

How could this not work? It would be a good, fast, way to pay them all off quickly.

Ugh. I was so wrong.

The minimum payments on all these bills was about $1500/month. Paying twice the minimum would be $3,000! By the end of the second month I barely had enough money left over for food!

What a failure!

The right way: Snowballing

This was pre-Google, so I couldn’t just google search “best way to pay down debt”. Luckily I found a financial advice book that explained a technique called “snowballing”.

Snowballing is pretty simple. The main points are:

- You’re going to pay the same total amount each month. (Say, $600)

- First pay the minimum on all your accounts. (suppose that totals $500)

- With the remaining cash (which would be $100 in this example), put that towards the one account with the highest interest rate. We’ll call this “remaining amount” the “extra”.

- Repeat until you’re debt is gone.

Any time an account gets paid off entirely, the “extra” grows. If your “extra” was $100, and you just paid off an account that had a minimum payment of $50/month, your “extra” is now $150/month ($100 + $50).

As each account gets paid off, this “extra” will snowball into a larger and larger amount. This will accellerate payments.

Snowballing is a healthy lie

Suppose we pay off a debt that is $50/month. Normally we celebrate the fact that now we have an extra $50 each month to spend.

The principle behind snowballing is that instead of spending that $50 on crap we don’t need, we’re going to pretend we don’t have that $50 and use it to accellerate our debt re-payments.

Its kind of like you are telling yourself a healthy lie: There is no $50/month “bonus”. We were used to living without it before, we can continue to live without it now.

Of course, we aren’t really living without it. We’re just using it for something very important: getting out of debt.

Snowballing example

In my case, I had $1500/month that I was already paying towards debt. I couldn’t afford any “extra”, so my “extra” was $0.

After a few months one of my accounts was paid off. The minimum payment on that account was $100. Now my “extra” was $100.

A few months later, another account was paid off. It had a $56/month minimum payment. My “extra” was now $156.

I tracked this in a spreadsheet. Each column represented a debt. I had a simple formula to calculate the “extra” for that month, which was put towards the debt with the highest interest rate.

I kept it simple and kind of game-like. The game was played like this:

- Every time you pay a debt’s monthly bill, record the amount (the minimum) you paid.

- If that was the last debt to be paid that month, you’ll know the extra. Send it to the debt that has the highest interest rate.

- Sometimes the “extra” goes to two different debts. For example if the “extra” is $100, and goes to a debt with only $80 remaining, pay off that debt in full and you’ll have $20 left. Pay that to the next debt you want to pay off.

I couldn’t find that old spreadsheet. I wish I could because it was an interesting history of my financial situation for a few years.

For the purpose of this article I created a spreadsheet to emulate what I had done. It is a bit more complex than the spreadsheet I used because I had to simulate the calculations the credit card companies were doing. That said, I got a little lazy and didn’t calculate interest. Maybe Version 2.0 of the spreadsheet will do that.

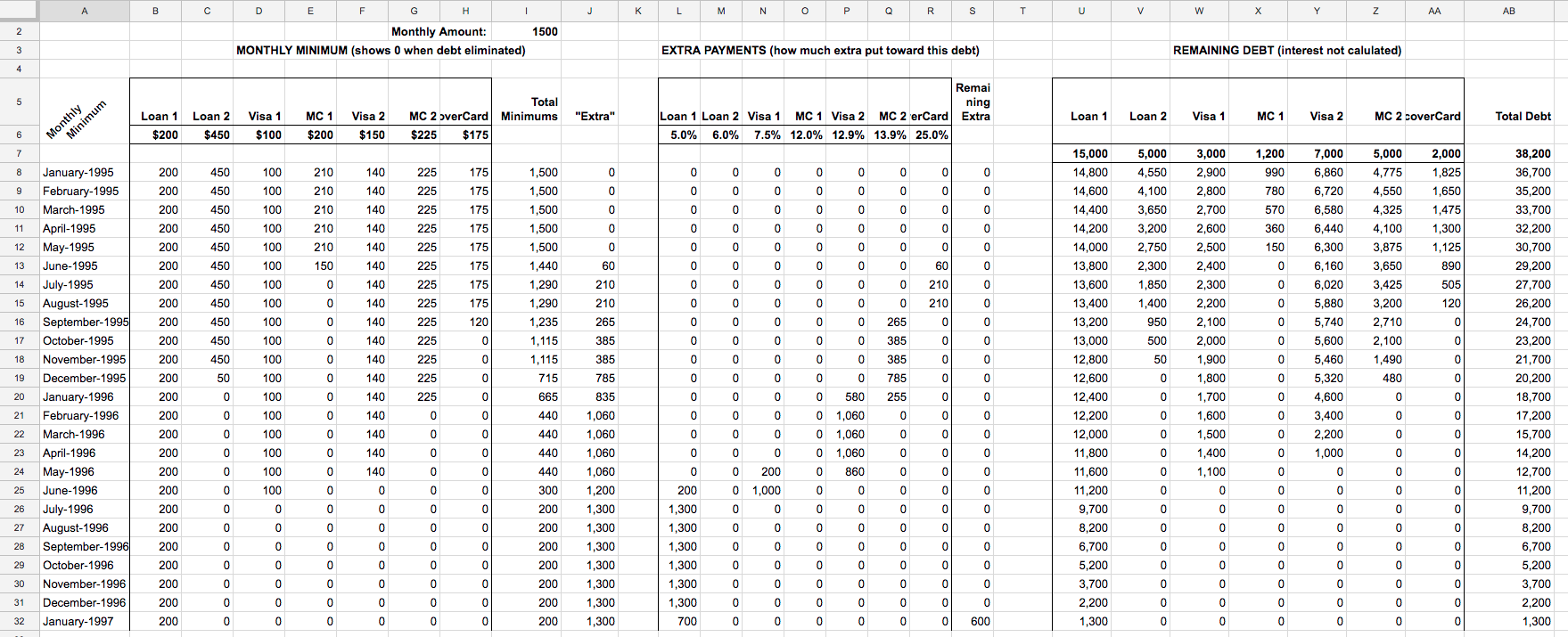

Here’s that spreadsheet. Click on it to see the whole thing.

Notice it has 3 main section: “Monthly Minimum” lists the minimum payment for that debt on that month. It drops to zero when the debt is paid off. “Extra payments” is how much of the “extra” was used on which debt; or “0” if no extra was used on that debt. The “Remaining Debt” column shows the total for each debt. Watch them go down, down, down.

Something interesting to notice about the spreadsheet is column “J” where the “Extra” is listed. Remember how we thought we were too broke to pay down our debt? By the sixth month we have $60 extra and soon we had more than a thousand “extra” each month to accellerate our debt payments. That’s money you had been without, so you won’t miss it. Yet, we got out of debt in only 2 years.

Another interesting thing about the spreadsheet is Loan 1. Notice that the minimum payment is $200. At that rate, it would take decades to pay off. In fact, that might not even cover the interest! You could be paying that debt forever! Banks do this all the time (especially auto dealers and credit card companies). They give you a pitch like, “we’ll let YOU set the monthly payment amount!” This sounds like a good deal until you realize 5 years later that the monthly amount you set just barely covers the interest. You’re going to be paying that debt forever. Fuck that.

Notice that with snowballing, once there was only a single debt left, it was paid off $1500 per month… less than a year of payments!

How to mess this up

One way to mess up Snowballing is to create more debt while you’re paying off the old debts. If you are snowballing 5 credit cards but adding debt to others, you’re going to end up in the same bad situation.

Therefore it is important to not accumulate more debt while snowballing. Set aside one credit card for any new purchases. Don’t include it in the spreadsheet. That card has to be paid off 100% each month. You have to live within your means.

Should I snowball my home mortgage?

Don’t include you home mortgage in your snowballing spreadsheet. Your home mortgage is an investment, not toxic debt. If you do include it, you won’t get to zero until your mortgage is paid off, which is a very long time. You won’t be able to go to the next stage of saving for your retirement.

Major life changes

You are going to be snowballing for a number of years. During that time things will happen: Raises, rent changes, you might move or buy a house.

If your income increases, I recommend you take the new, additional, money and add that to the “extra”. You were used to living without that money, so pretend it doesn’t exist. You’ll accellerate your debt payment considerably.

You might want to split the difference: Put half of the amount towards th extra and the other half towards spending money.

Similarly if you have a sudden new expense (rent goes up, etc.) you might consider re-evaluating how much your “extra” is. If you get married or otherwise go from single-income to dual-income, re-evaluate your debt situation.

Summary

Let’s compare our old behavior and our new behavior.

In our old behavior, when we paid off a debt we took the monthly payment we no longer had to make and used that money for short-term goals.

In our new behabior, we take that “extra” money and put it towards an important long-term goal.

Eventually you’ll be out of debt and ready for the next phase: saving for retirement.